The Importance of Including A Flood Zone Determination With A Title Search

Floods can be completely devastating to communities. The loss of life, property and livelihoods can leave survivors displaced because their homes and businesses are uninhabitable. The financial cost of replacing everything that was swept away is unimaginable.

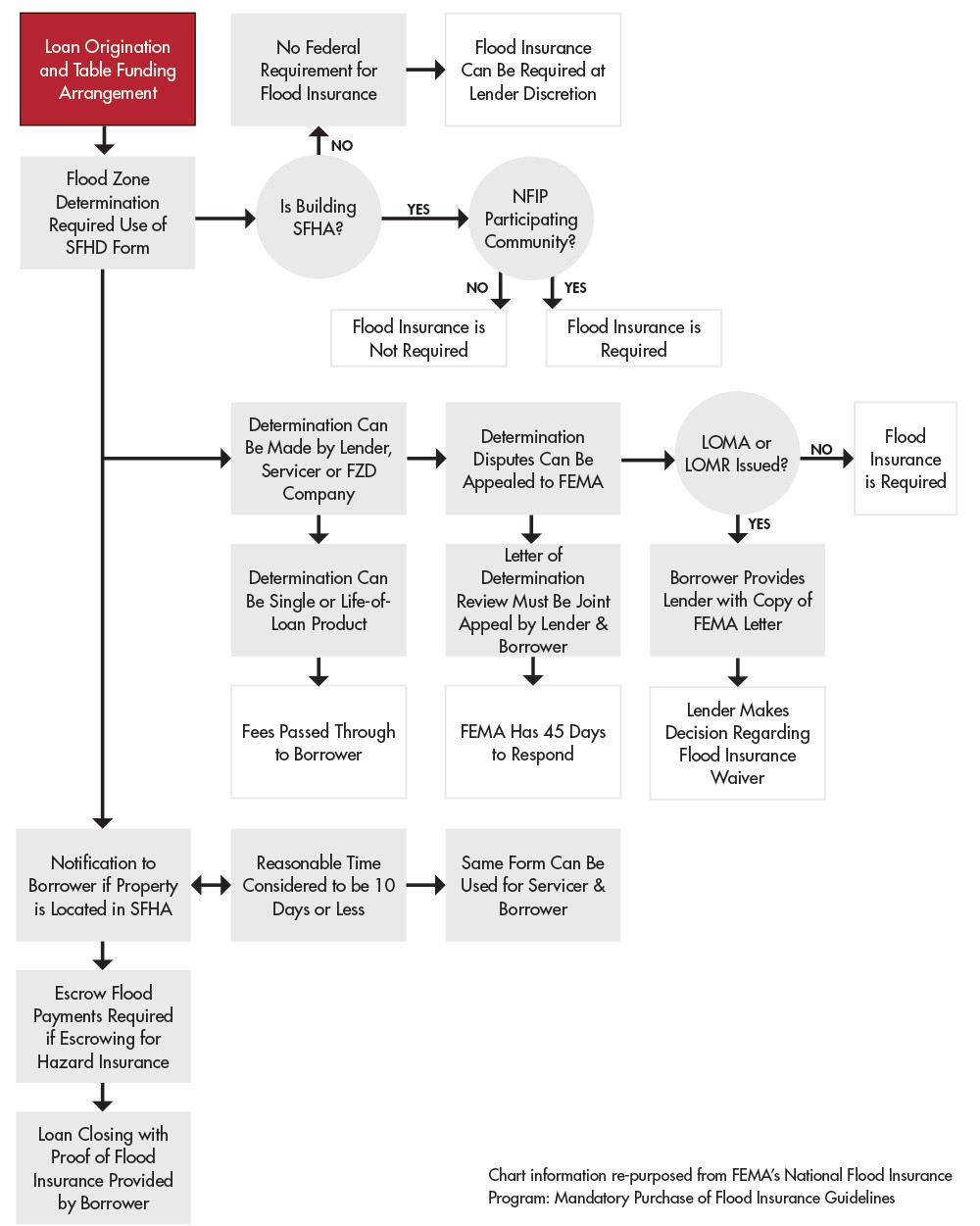

Professionals in the lending and real estate industries can have a powerful impact on their communities by assisting borrowers' understanding of flood zone risks. In fact, informing potential borrowers of a flood zone risk is more than a professional courtesy, it's the law.

Floods can occur almost anywhere, not just near rivers, coastal areas or other bodies of water. The US Federal government requires real estate, insurance or lending professionals, to inform customers of potential risks and borrowers of flood zone properties to obtain additional requirements and insurance premiums.

Flood zones are areas that are at risk of flooding as determined by FEMA (Federal Emergency Management Association) and noted on the agency's flood zone maps.

If the borrower's property, structure (or portion of either) falls into a flood zone, special insurance is required to protect the property owner, the financial institution and the community from devastation.

Lenders are aware of the flood zone certification (also called determination) documentation requirements and borrower insurance; however, many are not aware that a new flood zone determination is required in many circumstances.

There are many instances when a lender can not rely on a prior flood zone determination. Here are three examples when a new flood determination is needed even if the lender is just extending, renewing, or purchasing an existing loan.

Credit Transaction Requires A New Flood Zone Determination

Anytime a new credit action is taken the lender must seek a new flood zone determination, even if one was done at the loan origination.

7-Year Mark Requires A New Flood Zone Determination

A new flood zone determination is also required when the determination was made within the last seven years of the date of the original loan transaction.

FEMA Map Revisions Or Updates May Require A New Flood Zone Determination

Due to ongoing weather pattern shifts and flooding history, FEMA changes and updates the Flood Insurance Rate Map ("FIRM"). If there have been revisions or updates made to the maps a new flood zone determination should be obtained to remain in compliance.

Title professionals assist financial institutions and real estate companies to be in compliance by researching the property history and minimizing ownership risk not only for liens, easement and ownership issues but for determination of possible flood zones. It is important to consider doing the flood determination with the title search to avoid closing delays or compliance issues.

Hollerbach & Associates is proud to provide comprehensive title research so our lending and real estate clients can feel confident in property transactions. In addition to thorough title searches, we conduct searches in numerous ways. We feel it is important to include flood zone determinations with a title search to ensure compliance.

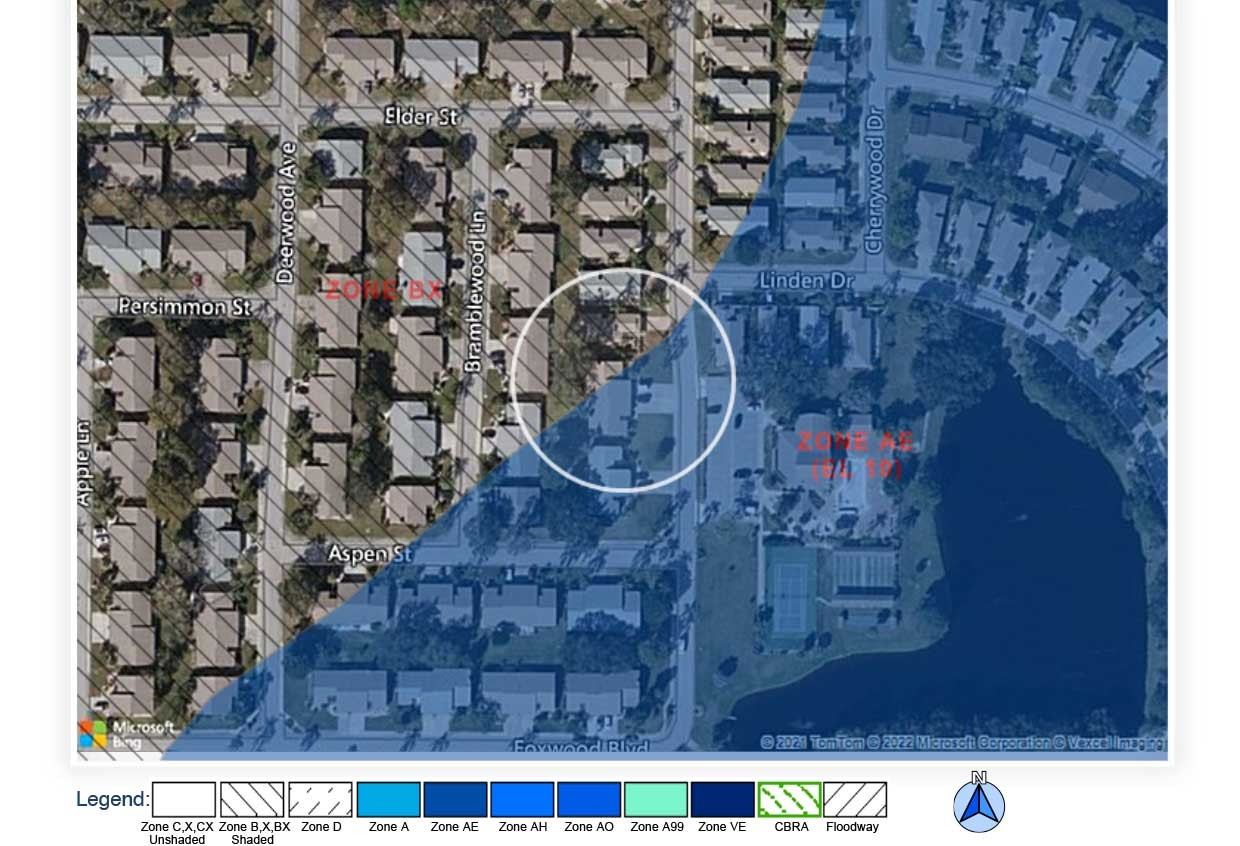

We partner with Service Link for flood zone determinations because it allows us to provide best-in-class technology and a commitment to upholding the highest standards of quality, compliance and service. ServiceLink has over 30 years of flood experience and services 4,000 plus lenders completing over 40,000 flood certificates daily. ServiceLink integrates various overlapping high technology mapping systems for accurate analysis of properties in potential FEMA flood zones. Their exclusive product "CertMap" is an aerial satellite image of the property with the FEMA flood map overlay to quickly identify which structures are affected by a high-risk flood zone to prevent over/under insuring, and best of all, it's free. Once a determination has been made, ServiceLink allows us to offer state-of-the-art digital compliance filing and the best possible customer experience insurance compliance.

For more information on flood zone determinations or our fast and accurate title searches throughout Texas and beyond, contact Hollerbach & Associates today!